No matter what combination of school funding you receive, you, your parents and you can UC for every has actually a crucial role during the using to suit your degree:

- Students: UC wants one to protection part of the cost of attendance because of working and borrowing from the bank.

- Parents: UC needs parents in order to contribute according to their money and you may issues once the claimed into FAFSA otherwise California Fantasy Operate Software.

installment loan company Austin PA

- UC talks about the remainder will cost you that have present the assistance of an option from supply. Each campus determines their total give eligibility and suits it using government, county and UC’s very own present aid programs.

Total price out of attendance: The complete cost of attendance was UC’s estimate of one’s annual finances if you find yourself browsing UC. It figure is founded on information you offer in the economic assistance software and you will has tuition and you may fees, and additionally books, houses, food and almost every other cost of living.

Current services (totally free $): Consider gift support as 100 % free money that you can use to cover your own educational expenditures. Gives and you may UC scholarships and grants belong to this category which help safety your price of attendance (that has tuition and you may charges, space and you may board, instructions and supplies, medical insurance, transport, and private costs).

Net pricing: The net cost – brand new portion your mothers have to pay – is the total price regarding attendance (or sticker price), without provide assist you discover. So it count is the most important factor to look at after you compare your UC educational funding provide in order to even offers from other colleges.

Make payment on online pricing

UC wants all student trying to educational funding to greatly help safety his otherwise the lady online costs courtesy a workable mix of performs and you will borrowing from the bank. Some tips about what we name notice-assist help: a mixture of finance and you will wages received away from jobs when you look at the academic 12 months and you will june.

The total amount your mother and father are needed to invest is decided depending to the guidance you bring into FAFSA or Ca Dream Act Software. To possess suprisingly low-earnings family members, there can be no mother sum requested.

Particular group have fun with a combination of current money and you will discounts so you’re able to security their express. For most family, even if, the combination away from deals and you can earnings is not sufficient to safety all of the its web costs.

Why does it-all match along with her?

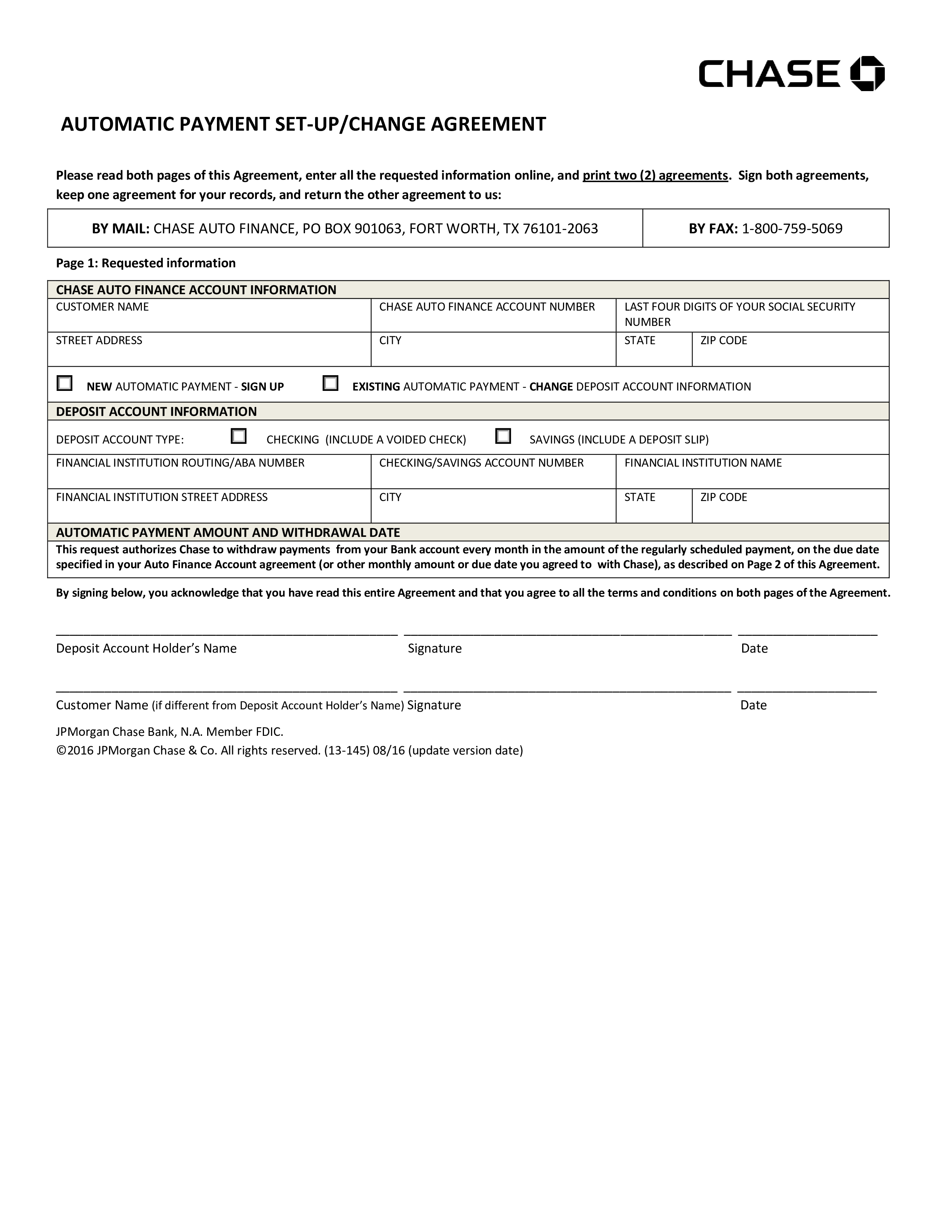

The brand new chart below suggests just how school funding matches together with parent and you can college student benefits to purchase total price regarding attending UC.

They suits merely given that the basics of wisdom their informative costs, since the price of attendance and financial aid availability alter 12 months in order to season, campus so you can campus.

- Youngsters away from lowest-income families and you can financially independent children will discovered gift aid and huge prizes than simply people of highest-earnings family members.

- The greater current assistance given, brand new faster pupils and you can parents have to contribute courtesy coupons, money otherwise money.

- The greater the amount of money top, the higher the brand new requested mother or father sum.

- Estimated costs includes way of living on the university; the purchase price for students who live off campus are down.

Consider, even people rather than economic you need can put on having educational funding. Regardless of if more ninety% out-of present assistance obtained from the college students are awarded with the foundation off need, a large proportion out-of college students at each income level discover some type of gift aid.

What’s in the a financial aid prize letter?

All beginner which enforce to have financial aid gets two things regarding for every UC university they’ve been admitted to: a grants or scholarships promote (which can research distinctive from university so you can university)and you will a standardized prize page named a grants or scholarships shopping sheet. Understanding how support performs (and you may once you understand terminology instance “internet pricing”) will assist you to decode the latest letter.

Usually my educational funding promote safety Most of the will cost you away from planning to UC?

Although college students located school funding which covers the price of tuition and fees, all of the school funding applicants are required to pay for a share of the price of attendance as a consequence of functioning and you can credit.

Can you imagine my personal parents can not or wouldn’t pay the questioned contribution?

UC will attempt to help you see even more financing so that you don’t have to really works over part-day throughout college or university. Both these could well be low-government, personal degree financing.